For many of you who use RPM, it’s important to maintain your clients’ balances within certain monetary limits—for example, many payors must keep less than $2,000 in their accounts to remain eligible for Supplemental Security Income. This is why it’s useful to enter balance limits and/or minimums on the Basic tab of the Clients screen.

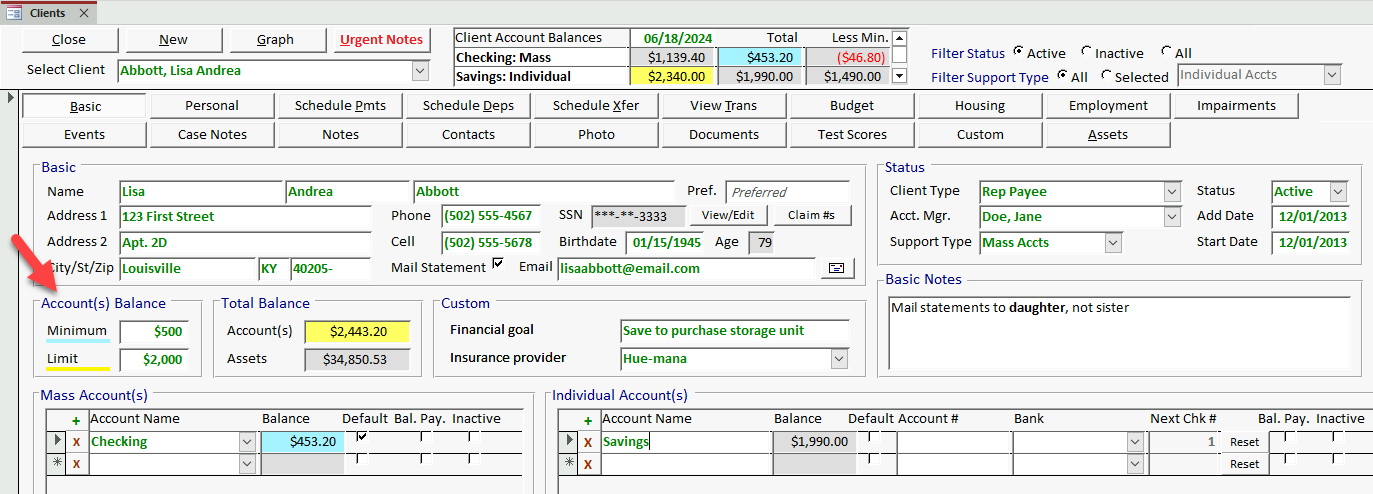

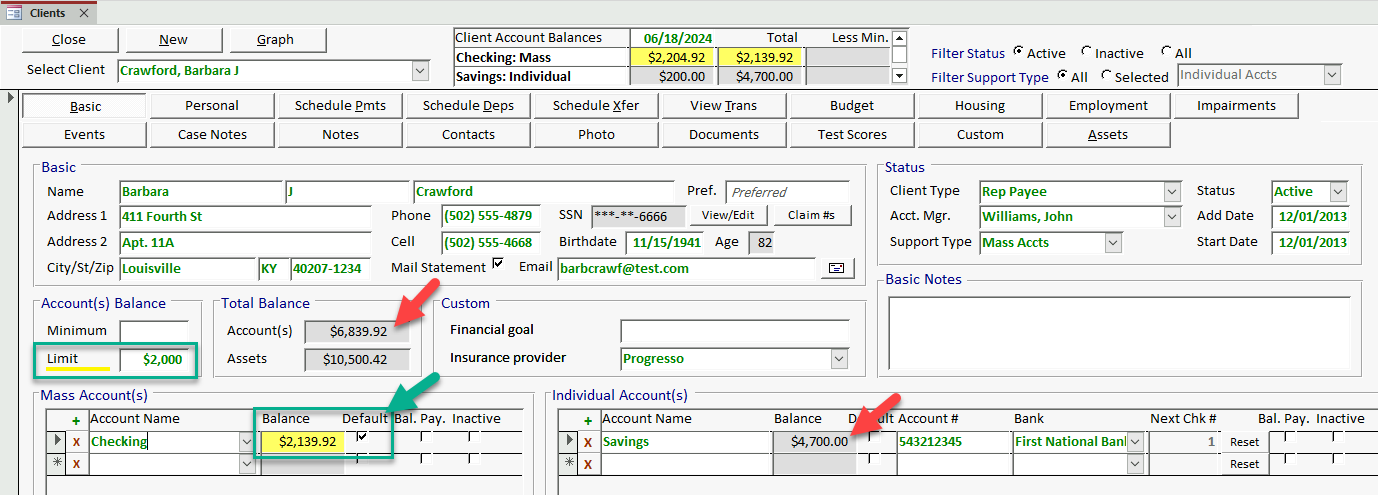

To make the balance limits and minimums even more effective, we’re adding the option to display colored highlights on client balances that are over their limit (yellow) or under their minimum (aqua). This way, pulling up a client’s record will immediately alert you that there is an issue with their current balance. See an example of how this will look:

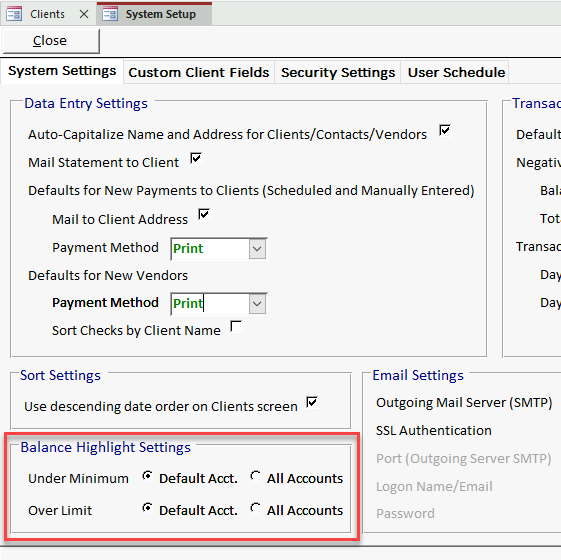

By default, as long as a client has a limit and/or minimum entered, the highlights will apply to each of that client’s accounts (if they have more than one) and to their total balance. However, we know that some of your clients have state-specific ABLE accounts in which they are permitted to save money over the amount of their would-be limit. For cases like this, we’ve included an option to apply the balance highlighting only to the clients’ default accounts, leaving their cumulative balance and any additional savings accounts unchecked.

Let me know if you think this change will be useful! As always, thanks for helping us make RPM better.